Quick Links:

The Beginnings of Cronyism

Bonds to replace the Irrigation System

Lease vs. Management Agreement

New Management Agreement

Invoicing and Accounting

Phony Golf Supplier

Missing Documentation

No Inventory Controls

Illegal Trash Collector

Purchase Card Abuse

Jay Lim Golf Academy

Maintenance Building Fire and Reconstruction

Other Projects without Competitive Bidding

The Fullerton Municipal Golf Course has been a part of Fullerton for numerous decades. American Golf has been the lessee and, more recently, the operator, under the terms of a new Management Agreement negotiated in 2010. The course was previously leased to American Golf (and its predecessors) dating back to 1979. Some clarity might be helpful as Fullerton has other golf facilities. The Fullerton Municipal Golf Course occupies almost 75 acres northeast of the intersection of Harbor Blvd and Bastanchury Road, running east to its boundary near Beechwood School.

American Golf operated the course as close as possible to a private business under the lease arrangement that was voided in December 2010. They were responsible for operating costs, liability, maintenance, improvements and employing the staff necessary to run the pro-shop, restaurant, and maintenance crew. In return, they paid the City of Fullerton 20% of gross golf revenues and 8% of gross restaurant revenue. This resulted in $300,000 to $500,000 of revenue to the Brea Dam Fund every year and was a good arrangement for the residents of Fullerton.

The Beginnings of Cronyism

Dating back to 2007 (and maybe even earlier) American Golf management started getting cozier and cozier with City of Fullerton officials including then-City Manager Chris Meyer, Joe Felz, and Alice Loya. Despite no contractual obligation to do so, the City agreed to construct netting in 2007 to protect the residents of Fairway Isles from golf balls leaving the course and entering their property. Some pretty obvious cronyism is apparent in this March 2007 agenda letter, as if American Golf deserved some sort of reward for their past performance.

They returned to City Hall a few months later and complained their water costs were up 83%, electricity up 28%, maintenance up 22%, carts up 50%, and other expenses up 67% over the year prior. Somebody wasn’t being completely honest with their math because utility rates didn’t increase that fast in one year’s time. It was likely the result of increased usage.

Bonds

Fast forward to 2010. The recession was being felt hard by everyone. The City of Fullerton was forced to make cuts across the board that year, including cuts to Parks and Recreation. Meanwhile, as part of the stimulus package, the Federal government offered Recovery Zone Economic Development (RZED) Bonds in the American Recovery and Reinvestment Act of 2009. Fullerton applied for, and received, an allocation of $2.7 million. Despite having nearly the entire year to find a more suitable project, City Hall decided to issue bonds to replace the sprinkler system at the Fullerton Golf Course. No joke. Remember, Fullerton was under NO OBLIGATION to do this since American Golf was responsible for course improvements.

The bonds were pushed through a City Council meeting on November 2, 2010 — the same day as mid-term elections when the City knew everybody would not be paying attention. The RZED bonds were hidden pretty well by combining their issuance with Water Revenue bonds. The debt service schedule on these bonds paints a rather awful picture: $5.1 million for an irrigation system that was successfully bid at $1.7 million.

The City justified the high-rate of interest on these bonds because the Federal government promised a 45% refund on the interest payments. Nobody cared that taxpayers will still be on the hook for that amount (over $1 million) by the time the bonds reach maturity. All of this for silly irrigation system replacements at a golf course.

Bonds are pretty much poison for many reasons, including their cost of issuance. Of the $2.705 million, approximately $370,000 was estimated going places other than the golf course project. (Note: The Series B bonds were the water revenue bonds issued at the same time, unrelated to the golf course.)

The detailed paperwork on these Series A (and B) Bonds is here.

Once the bonds were passed, Alice Loya at the following City Council meeting requested the Golf Course Lease be converted into a Management Agreement because it was required of the bonds. Why wasn’t this done first?

Analysis of the video below:

| 1:09 | They picked the golf course project because the irrigation system was old. Why didn’t she tell the City Council that we were under no obligation to fund that project? |

| 2:31 | “The City is not responsible for any of those things, we just receive the revenue.” What then was the point of issuing the bonds? Just a favor to American Golf? |

| 2:35 | “Operating costs are about $1.1 million dollars per year.” American Golf’s financials show costs for 2011 as being over $1.5 million, which means her figure was understated by 36%. http://breadam.org/wp-content/uploads/2015-Fullerton-GC-Annual-Comparison-and-Plan.pdf |

| 3:08 | “We plan to pay American Golf a management fee of $500,000 a year and it will increase at 1% each year.” FALSE. The real figure from the signed contract is $670,000 with 1% increases. |

| 3:20 | “The agreement is required to be at least 15 years.” Not true as far as I can tell. In fact, under IRS rules, the maximum is 15 years, which is probably the term American Golf demanded for their own self-serving interests. |

| 3:58 | “American Golf will receive $500,000 fee … Debt Service will be paid out of the gross revenue.” Again, FALSE. The real number is $670,000. |

| 4:06 | “The difference between these two agreements is that the City will make a little more and American Golf will make a little bit less.”

This is complete deception on her part. See below for additional discussion on that. |

| 4:50 | “The liability lies with the golfer.” What about all of the other reasons people might sue? |

| 7:10 | “What we think we’re going to do is American Golf will continue with their carrier and coverage and we will reimburse them for it.” They don’t know the answers yet but they’re asking City Council to say yes anyway? A complete failure by both sides. |

Lease vs. Management Agreement

The slide pictured below is very deceptive. Note the Debt Service amount of $36,520 and compare it to the table on the right which shows $66,956 for 2011.

Nothing was paid toward the principal in 2011; only interest payments. $36,520 divided by $66,956 = 0.545 which means Alice already factored in the Federal interest subsidy of approximately 45%.

Come 2012 and later years when the principal payments and higher interest kick in, this changes her analysis completely. Applying her same logic to 2012: $197,575 multiplied by 0.55 = $108,666 in interest payable. Add the principal of $90,000 and you get $198,666 in debt service payments for the year. The $500,000 management fee must also be changed to $670,000. With her same revenue and expense assumptions, the “net revenue” for 2012 plummets:

$2,230,000 minus 1,140,000 minus 670,000 minus 198,666 = $221,334. She never explained that to the City Council. Meanwhile, the City remains responsible for expenses that continue to climb, and American Golf is guaranteed $670,000 no matter what they do with 1% increases annually.

|

|

Ms. Loya also failed to tell the City Council we had to purchase from American Golf all of the pro-shop and restaurant inventory plus the furnishings, and all of the tractors and lawn mowers for an extra amount.

Nevertheless, nine minutes after Ms. Loya stepped to the podium, the City Council approved a deal without knowing the details of, or ever seeing the new management contract. A deal that over the length of its fifteen year term will require $50 to 60 million of expenditures.

New Management Agreement

American Golf Management Agreement — 12-1-2010

The new management agreement negotiated by Joe Felz and Alice Loya was never seen or approved by the City Council or Parks and Recreation Commission. Ms. Loya simply requested permission to enter into this agreement, a very dangerous way of doing City business. At no time should the City Council be authorizing City staff to enter into deals of this nature until the contract language can be properly reviewed in open session.

Overall, the terms of the agreement are unreasonably favorable to American Golf:

- Wages, pensions, healthcare, and other benefits of American Golf employees (except for the General Manager and Superintendent) are paid by the City of Fullerton through reimbursement to American Golf. There is no limit on compensation or staffing levels. See sections 3.6.2, 3.7, and 6.2.

- American Golf told the City what insurance policies they wanted and the City agreed, to the point of giving American Golf the right to demand extra insurance as they see fit. As part of this, the City is paying for crime insurance in the event of dishonesty by American Golf employees. Yes, really.

- American Golf gets to write their own budget documents as part of their “Annual Plan.” Unless the City voices any objections, the Annual Plan is automatically approved. There’s some inconsistencies because Section 3.2.1 gives the City 60 days to approve the Annual Plans, while Section 3.2.2 limits the same to 30 days. Practically speaking, this has made no difference because Alice Loya never issued the written approvals as required by Section 3.2.2, meaning the Annual Plans were approved by default. Read my e-mail exchange with Ms. Loya on this. Not only were approvals never issued, she was unable to produce any of the Annual Plan documents highlighted in green (below) with the exception of an Equipment Inventory. Unless the remaining documents were lost at City Hall, American Golf is not complying with the Annual Plan requirements and apparently nobody from the City has held them accountable for that.

- The City cannot cancel the agreement before its expiration date unless American Golf violates the terms or files for bankruptcy, or else a flood or fire causes significant damage to the course. See sections 7.1 and 9.1.

- Holding American Golf accountable to their “Annual Plan” budget under Section 3.2.3 is virtually impossible for two reasons. American Golf works on a normal calendar year, but the City’s fiscal years run from July 1 to June 30. Secondly, many of the expenses they submit for reimbursement are on a cash, not accrual basis, meaning it might be impossible to assign the expenses to the proper period to make any meaningful comparison.

- The agreement covers operation of the pro-shop and restaurant/snack bar, but is almost silent on specifics. For example, nothing is said about the collection and remittal of Sales Tax. As a result, the sales tax is paid to the City as ordinary revenue, then American Golf bills them for it like a regular expense, thereby artificially inflating the golf course revenues and expenses. I’m told this practice may be considered illegal by the Board of Equalization. Who is responsible for ensuring control of the inventories, or that the restaurant complies with health department rules? Does the City realize employees of the pro-shop are paid sales commissions? Who really holds title to the pro-shop inventory on hand? These and many more specifics should have been properly addressed in the Management Agreement.

American Golf can demand more money from the City on just five days notice. Section 6.4 requires the City to hand over records to American Golf, but there is no explicit requirement for American Golf to do the same.

- In the event the City suspects any financial misdeeds and desires an audit, American Golf will “train” and “supervise” the accounting firm.American Golf claims ownership in the accounting software used — even though the City is likely being billed their share of the costs — and once the agreement expires or is terminated, the City has no right to that software. This appears to be some sort of extortion to discourage termination of the agreement. In the event such software is proprietary to American Golf, the City has no choice but to preserve the agreement if they want access to the accounting records.

- Section 3.6 contains a convenant not to compete for the General Manager that is illegal under California law. They forbid the City of Fullerton from employing any American Golf general manager who worked the Fullerton Golf Course for one year after the City terminates the contract.

Business and Professions Code §16600: 16600. Except as provided in this chapter, every contract by which anyone is restrained from engaging in a lawful profession, trade, or business of any kind is to that extent void.

More background is widely available on the internet, but here are a couple links:

Employee Covenants Not to Compete: The Myth of Enforceability and Alternative Protective Measures Available to California Employers - Despite the agreement being full of references to litigation and other proceedings, the final clause of the agreement is a Waiver to Jury Trial with no Arbitration Agreement attached to it. This was ruled unconstitutional by the California Supreme Court in Grafton Partners L.P. v. Superior Court (2005) 36 Cal.4th 944 some five years before the Management Contract was entered into.

More background info here: Wave Goodbye to Pre-Dispute Jury Waivers

More background info here: Wave Goodbye to Pre-Dispute Jury Waivers

Hello, Mr. City Attorney? Did you or anybody else from Jones & Mayer proofread this contract at all? For that matter, do you regularly sign contracts that are so lopsided against your clients, and contain illegal provisions?

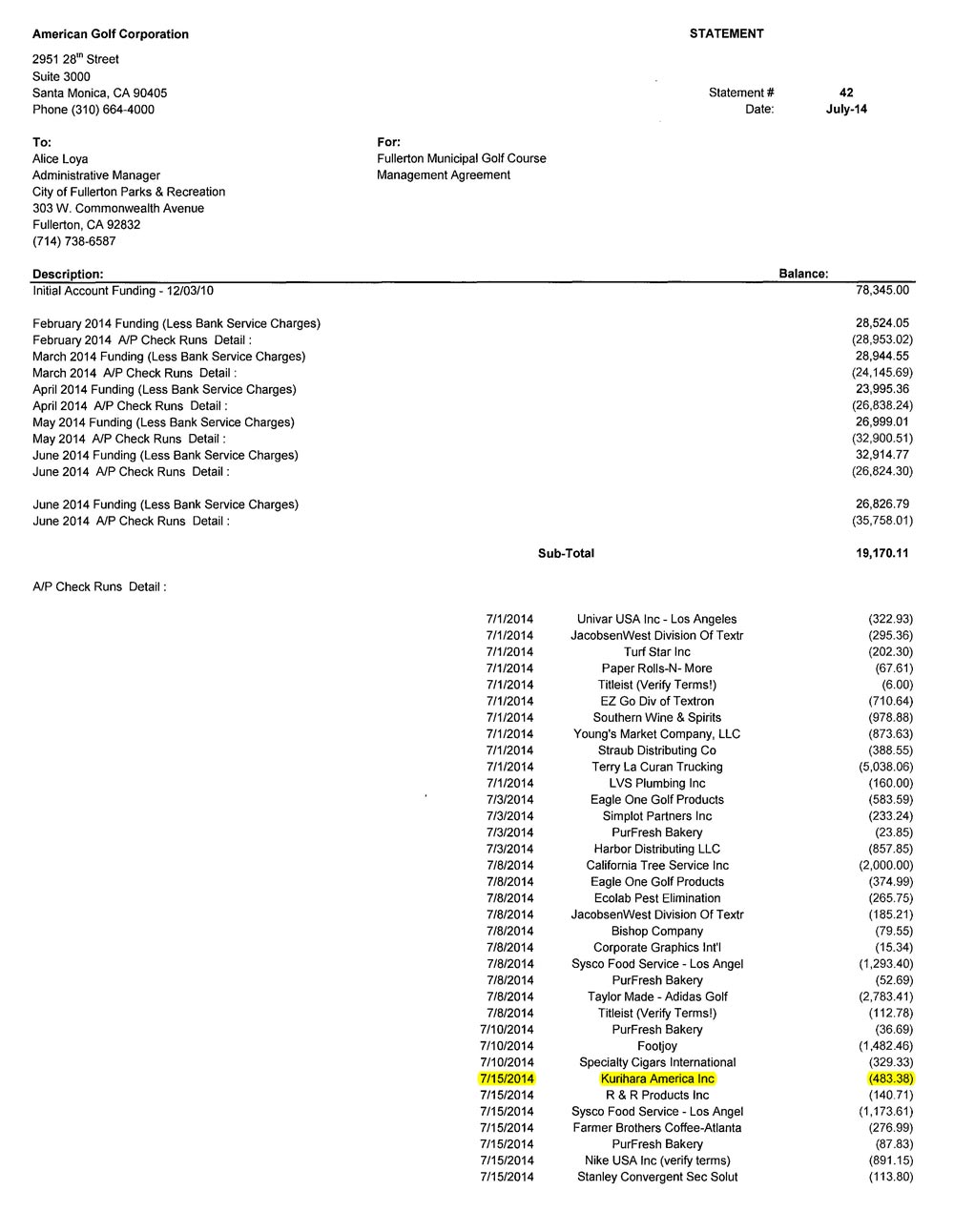

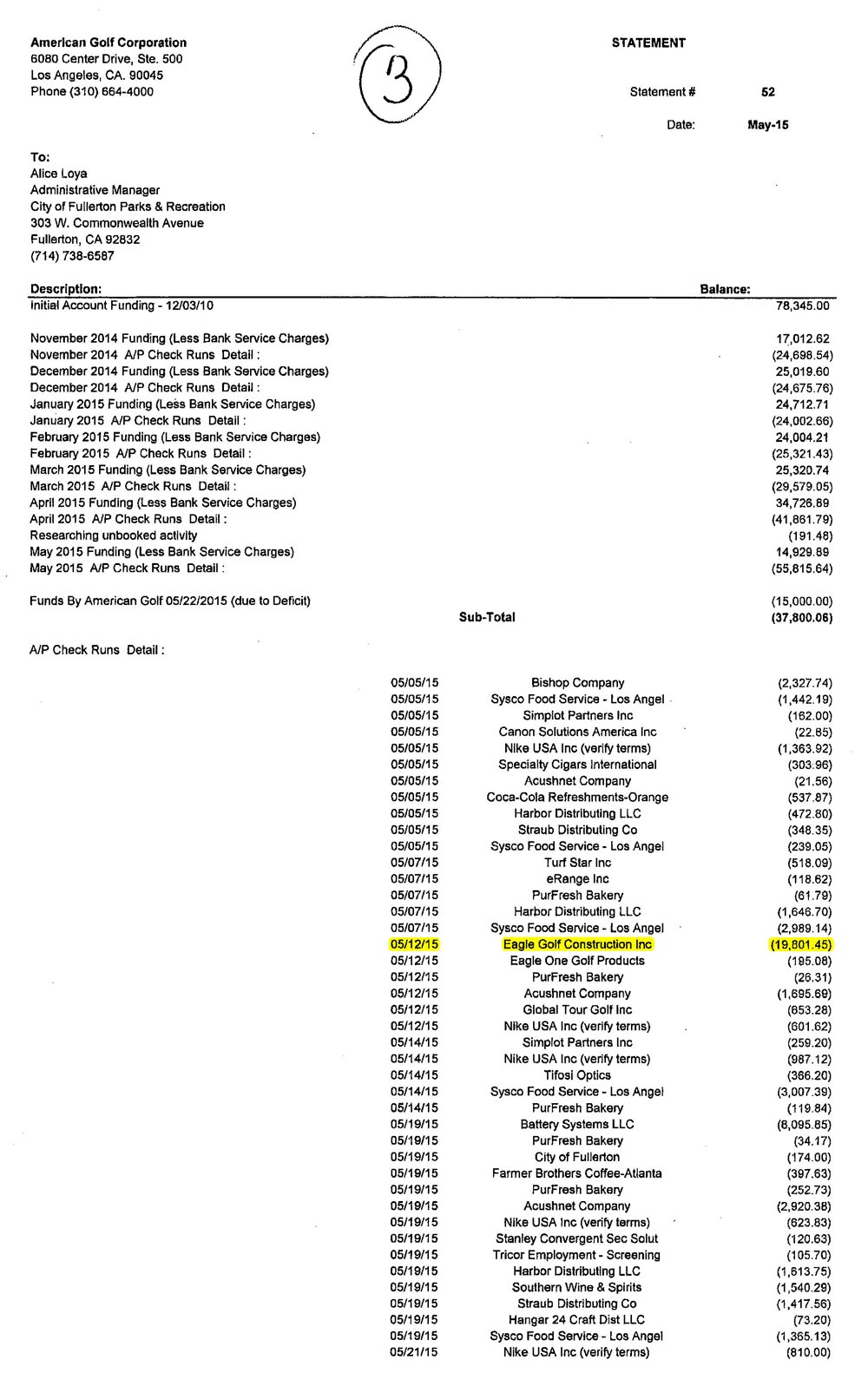

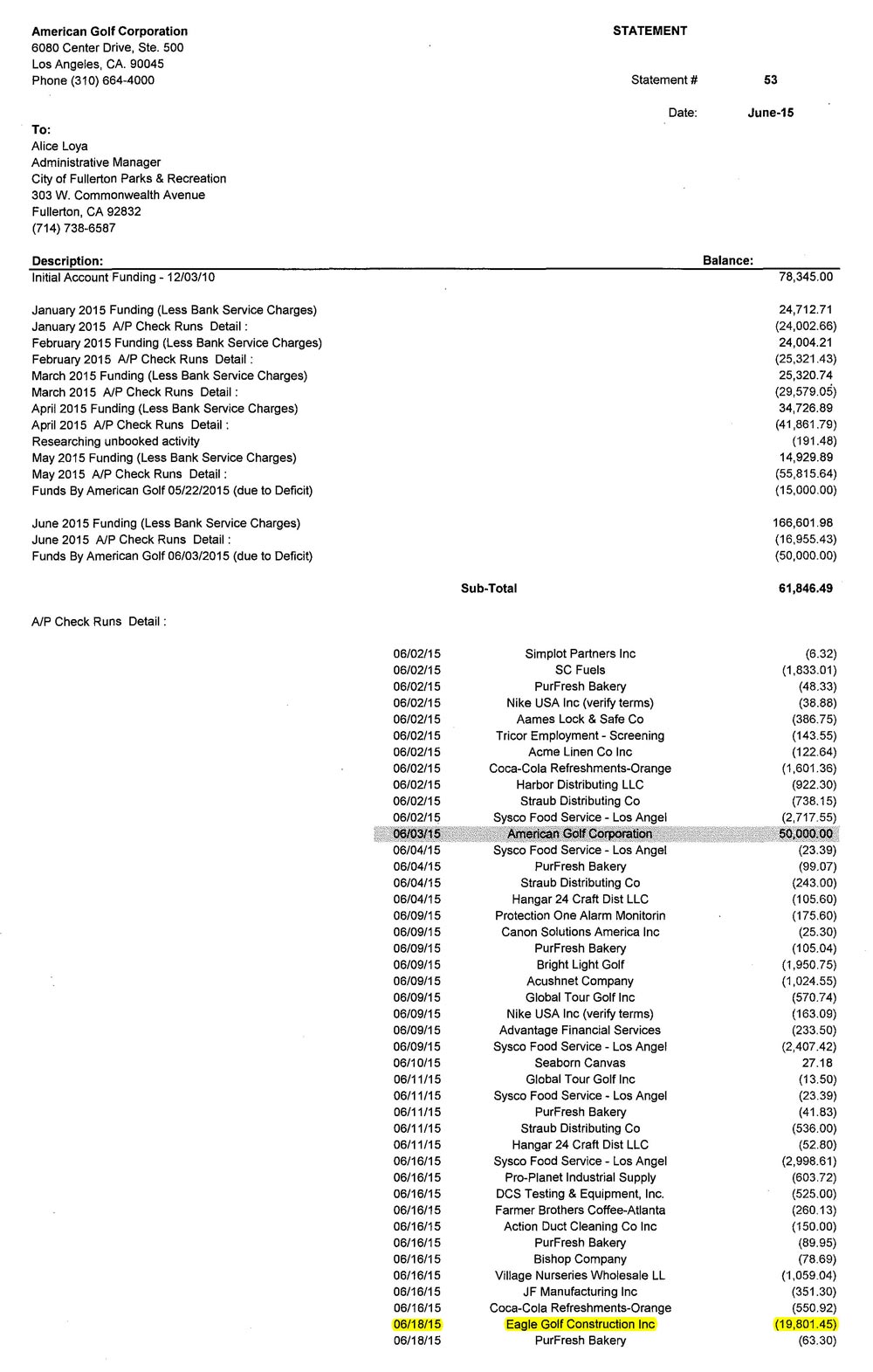

Invoicing and Accounting

Every month, American Golf submits to the City of Fullerton an “invoice bundle” consisting almost entirely of payroll reports, printouts for the managers’ purchase cards, and the bills paid for water, electricity, and natural gas. I requested from the City a full twelve months of these American Golf reports covering what would be the City’s 2014-2015 fiscal year.

The bundles come in two parts, representing multiple accounts. There’s always a spreadsheet like this one:

See the line toward the bottom “Internet Sales – Players Club/Golfzing” and how the amounts are listed in parentheses? American Golf is supposed to be sending the City 100% of the revenue they receive. Here, they are hiding internet sales revenue inside the Billing Invoices to reduce expenses.

Another part of the invoice bundle is this additional invoice for the checking account. They do not invoice for actual expenditures! They bill for whatever cash is necessary to restore the checking account to a minimum balance of $55,000. This method makes it extremely difficult to follow checking account expenditures because you would have to know the beginning and ending balances first, then calculate from there how they arrived at each.

What’s worse is how they attempt to justify their checking account expenditures. They include this report from Wells Fargo which shows checks being cashed, but nothing to authenticate the payee — only check numbers.

Instead of a bank report affirming the payee, they include their own reports of expenditures — with no check numbers to match up to the Wells Fargo reports. Pay close attention to the supplier “Kurihara America Inc” (below). More on that in a second.

The 12 months of invoicing bundles can be found on the Files page under Fullerton Golf Course.

Phony Golf Supplier

If anyone thinks I’m being overly pedantic about proving their expenses, perhaps this will change your mind. See the entry above for Kurihara America Inc?

They filed for Chapter 7 Bankruptcy in 2011 and estimated no future income.

The corporation was subsequently dissolved with the California Secretary of State in 2012 according to the report on Wysk.com. You can also verify this on the State’s website although no dissolution date is listed. The date indicated below is the day the corporation was formed.

The bottom line is that Kurihara America, Inc. — a corporation no longer authorized to conduct business in California — was still being paid by American Golf with City money as recently as 2015.

Missing Documentation

Nowhere in these reports does American Golf provide receipts or invoices to support expenditures for the following:

- Insurance

- Worker’s Compensation

- Benefit Costs

- Health and Pension Plan Expenses

- Leases on the golf carts (over $100,000/year)

- Phone bills which vary widely from month-t0-month

- IT expenses

- Sales Tax collected or remitted to the Board of Equalization

And many more items. Monthly payroll expenses are frequently $3,000 to 5,000 higher than their payroll reports indicate. Utility expenses don’t always match up. Most of the pro-shop and restaurant inventory is handled from a separate checking account, with expenses not appearing on the billing invoice spreadsheet.

I politely pressed Alice Loya on this issue multiple times and this was her response (in red):

Her rationale for not having copies of these documents is that the City doesn’t deem it necessary to keep them on file, even though American Golf is supposed to be submitting invoices for everything.

Likewise, she doesn’t appear concerned that documentation is missing for things like benefits and insurance because those documents were approved FIVE years ago when the management agreement was first entered into in December 2010. Hello? Health insurance plans (and costs) have changed substantially since 2010. Important documents like subleases to a golf academy (which isn’t authorized to be there anyway) aren’t important to have and preserve either?

No Inventory Controls

On behalf of the City, American Golf purchases large amounts of alcohol, cigarettes, cigars, food, apparel, and golf equipment to sell in the pro-shop and restaurant. No documentation is included in the monthly invoicing bundles to report on inventory levels. The City apparently doesn’t capitalize smaller items, so the inventory levels on the City’s books haven’t changed in years.

Given the above problems with purchase card abuse and suppliers who no longer exist, performing audits using American Golf’s inventory lists (the way Ms. Loya describes below) may well be a useless endeavor. Large amounts of inventory may or may not be missing, but it’s impossible to know either way with such poor records being furnished.

This isn’t good news because with Crime Insurance, paid for the by City, American Golf doesn’t have much of any incentive to safeguard the inventory as they once did.

Also disturbing from an accounting and claims perspective is proper accounting of the larger items. Who owns the computers, printers, big screen TV’s, the tables and chairs, desks, bookcases, and all other furnishings of the offices? Does the City really hold title to the lawn mowers, tractors, and the tools which were destroyed in the maintenance building fire?

There were no adjusting entries made in the Brea Dam Accounting Ledger to recognize either the losses incurred in the fire, or the purchases American Golf made to replace items that were destroyed.

Illegal Trash Collector

Waste Management is the golf course trash collector, which is illegal under Chapter 5.14 of the Fullerton Municipal Code. Republic Services (aka MG Disposal) has an exclusive franchise to be trash collector in Fullerton. I received confirmation from both Republic Services and the City of Fullerton that Waste Management is prohibited from doing business here. Violations under FMC 5.14.100(B) shall be “punishable as misdemeanor or an infraction, at the discretion of the City Manager…” [emphasis added]

That’s wonderful! Now, Joe Felz can issue a citation to himself.

Purchase Card Abuse

The managers of the golf course have purchase cards to buy necessary supplies and equipment, the costs of which are reimbursed by the City of Fullerton. I think most expenditures are legit. Some most definitely are not.

Below:

- $475.00 for employees to attend the Monarch Beach Golf Club tournament in Dana Point, charged to Employee Relations.

- $159.82 for camera for golf course. May or may not be legit.

- $361.18 for business cards for Coyote Hills Golf Course. This is the entry that screams outright fraud. Coyote Hills GC is a different course entirely, also operated by American Golf, but NOT subsidized by the City of Fullerton. I thought maybe just the descriptor was wrong, but no, check the Txn Allocation in the righthand column: 270-80-53320 is not the Fullerton Golf Course.

Both managers buy gift cards for employees, and charge them to the City of Fullerton as operating expenses. In the documentation provided for FY14-15, I found $2067.05 of gift cards purchased.

See the gasoline expenses for bank trips? These fill-ups often occur in Huntington Beach or Corona, and listed for the same purpose. There’s no disputing that vehicle expenses are legitimate for business purposes, but not entire tanks of gas purchased 20 or 30 miles away.

Another item frequently listed is big dollar purchases for “Clubhouse Flowers”. Having seen the flowers around the clubhouse many times, I struggle to comprehend the expenses on these, which appear to have cost $3388 in FY14-15 if the purchase descriptors are accurate.

Take a look. I see lots of well-established shrubs and perennials, rose bushes, dwarf palm trees. What looks recently planted, even if replaced on a regular basis, could be bought very cheaply at Home Depot. Given the inappropriate charges for many other items, including business cards for Coyote Hills Golf Course, is it possible they’re buying flowers for Coyote Hills and charging them to the City?

The golf course superintendent goes to Stater Bros. down the street and purchases employee snacks and drinks, then bills the costs to the City:

Professional dues and events for American Golf managers (who aren’t compensated by the City) are also being billed as ordinary expenses. Why aren’t these expenditures being paid at American Golf’s discretion from the management fee they receive from the City — now approaching $700,000 annually — and not as an operating expense?

GCSAA EIFG (below) stands for Golf Course Superintendents Association of America, Environmental Institute for Golf.

National GM Conference at the Marriott in Anaheim:

Is this $579.00 for a personal PGA membership, or does it have something to do with the golf course?

How about this one, “bolts and rods” purchased at Office Depot.

Jay Lim Golf Academy

There’s a golf academy operating out of the Fullerton Golf Course. No big deal, right? Think again.

The City converted the Golf Course Lease to a Management Contract because, as a condition of the bonds and the interest subsidies paid by the Federal government, leases are not allowed. Under IRS rules, the rationale is that leases are “private business use”. The RZED bonds the City received to replace the golf course irrigation system strictly prohibit the bonds from becoming Private Activity Bonds.

A CPA who helped with some of the research expressed concern that the presence of the golf academy under a sublease could pose big problems with the IRS. If American Golf is not permitted to operate under a lease, neither would this golf academy.

How do I know the golf academy is operating under a sublease? Alice Loya told me so near the bottom of this e-mail (her reply is in red).

The City and American Golf have absolutely no authority under the Brea Dam Lease to sublease or otherwise permit Jay Lim Golf Academy to be there unless the Army issues prior written approval. Nevertheless, their presence at the golf course may well catch the ire of the Internal Revenue Service and drop the hammer over those irrigation bonds.

This section talks about Private Activity Bonds:

26 U.S. Code § 141 – Private activity bond; qualified bond

Definitions, tests, and remedial actions:

26 CFR 1.141-3 – Definition of private business use.

26 CFR 1.141-2 – Private activity bond tests.

IRS Revenue Procedure 97-13 discusses management contracts and what is required to prevent “private business use”:

The Recovery Zone Economic Development Bonds are discussed here. Note the final sentences clearly say public projects and public infrastructure, not private activity.

26 U.S. Code § 1400U–2 – Recovery zone economic development bonds

Another reference that might be helpful is this training module from the IRS:

https://www.irs.gov/pub/irs-tege/teb_phase_1_course_11204_-5module_d.pdf

Maintenance Building Fire and Reconstruction

In March 2015, the maintenance building at the golf course burned down near Beechwood School. American Golf was given the authority in the Management Agreement to handle “claims” as follows:

They did handle the claims and hired an appraiser to assess the damage. This resulted in the City having to pay the $250,000 insurance deductible in May 2015. The admissions by City staff in that link are disturbing because where does American Golf get the authority to spend the City’s insurance settlements as they see fit? This is a private corporation spending City money to buy City assets with no oversight.

The insurance money, including the City’s $250,000 deductible payment, is being hidden away in some private American Golf account and the reports to the City (required by Section 4.4, above) on claim activities, if any exist, have not been included in the monthly invoicing bundles.

Also puzzling is why American Golf received the money at all. Section 4.1 says the City of Fullerton shall be named as loss payee.

In fact, two of the items destroyed in the fire were Sod Cutters. Instead of using insurance payments to replace them, American Golf bought new ones from the operating expenses account, which constitutes double-dipping, if not fraud:

The Golf Course Equipment Inventory (dated August 20, 2015) shows only ONE sod cutter. I hope the other Sod Cutter didn’t end up down the road at Coyote Hills Golf Course…

And now, for something much worse. It appears that American Golf is rebuilding the maintenance building using the insurance settlement they received. There was NO Competitive Bidding on this project, as required by California’s Public Contract Code. To my knowledge, the City Council DID NOT approve the plans or expenditures, or even receive a briefing on their intentions.

I called Public Works at City Hall a couple months ago and was told that Parks & Rec is handling this project. And just to be clear, despite the repeated insistence by City employees, this is NOT a shed. Sheds don’t have cinder block walls, 200-amp electrical service, and air conditioned office space.

Progress on the building as of November 1, 2015:

It should be noted that I called the California Department of Industrial Relations https://www.dir.ca.gov/ and explained in great detail what was going on here without divulging the location or city name. They called me back a couple hours later after talking this over with their legal counsel. Nobody was aware of any exception in the law that would allow Fullerton to do this without competitive bidding. At that point, they gave me the name/number of a local contact person to start an investigation. And, no, I did not follow up.

Other Projects without Competitive Bidding

The maintenance building reconstruction is not the only instance where the City failed to obtain competitive bidding.

In 2014, netting along the golf course needed to be replaced. The building permit estimated the value at $140,000 but there’s no evidence of any informal bidding process used to find the lowest bidder. Actual cost was approximately $160,000.

It would appear they simply called up the contractor previously used in 2007 because the name matches in both places. They did solicit competitive bids for the 2007 project.

More recently, American Golf paid $39,602 to a contractor named Eagle Golf Construction. The payments were split 50/50 between May and June.

What project was this for? Did it qualify as a “Major Capital Improvement” as described below? Was it something that needed US Army Corps of Engineers approval? All of these things are impossible to know when everything is done in secrecy.

# # #

What lesson can be learned from all of these problems? Private businesses doing favors for government — and vice-versa — all but guarantees corruption and fraud, with the end result being zero accountability on each side.

It’s up to the residents of Fullerton to prevent this from happening again.